The Company Notes provide immediate funding, which NUBURU intends to use to maintain its investment in its next-generation AI product line and to pursue new technology development. Steps taken to build on the positive momentum of the proposed business combination transaction with TWND include adding a key capital markets advisor and completing significant diligence processes.

“We are excited to formally announce that Tailwind has completed its diligence, which was the final diligence-related milestone that could have triggered termination of the business combination,” said Dr. Mark Zediker, CEO, Co-Founder and President, NUBURU. “As a result, we’ve removed a potential gating item to our merger and eliminated key conditionality relating to the business combination.”

“In light of this successful financing, the previously announced funding agreement for up to $100 million, and the absence of a minimum cash condition in our transaction, we remain excited about the opportunity this deal provides to both sets of stockholders,” said Chris Hollod, Chief Executive Officer and Director of TWND. “We are continuing our positive momentum towards closing this deal in Q1 of 2023.”

Company Notes

The Company Notes will convert into shares of NUBURU common stock immediately prior to, and subject to the occurrence of, the closing of the business combination, which common stock will convert into common stock of the combined company at the closing of the business combination. As holders of common stock of the combined company, the former holders of Company Notes would also be eligible to receive shares of Series A preferred stock of the combined company on the same terms as the TWND public stockholders. The conversion price is subject to an initial valuation cap of $350 million for Nuburu as a private company. Additional details on the terms of the Company Notes are available in the recently published FAQs regarding NUBURU’s go-public transaction with TWND and are available at SEC.gov, with Questions 22 and 23 specifically addressing the Company Notes.

Key Milestones

- TWND completed its diligence, which was the final diligence-related milestone that could have triggered termination of the business combination, removing key conditionality relating to the business combination. The proposed business combination is expected to close in Q1 2023, subject to stockholder approval and other customary closing conditions.

- If the upcoming extension proposal is approved by TWND’s stockholders at TWND’s September 7th extension vote meeting, TWND’s sponsor (or one or more of its affiliates, members or third-party designees) has agreed to provide an incremental contribution to its trust account. For the initial four-month extension ending on January 9, 2023, TWND will contribute the lesser of $500,000 and $0.25 per share of common stock not redeemed in connection with the extension. For each of the two subsequent one-month extensions required to close the business combination, TWND will contribute the lesser of $50,000 and $0.025 per share of common stock not redeemed in connection with the extension.

- Based on the combined anticipated financing sources including TWND’s cash in trust (following redemptions), the preferred share structure designed to incentivize non-redemptions and the Lincoln Park Capital funding agreement for up to an aggregate of $100 million, subject to the closing of the transaction and other conditions set forth in the purchase agreement entered into between TWND, NUBURU and Lincoln Park Capital, the proposed transaction has no minimum cash requirement for closing.

- Cohen & Company Capital Markets, a division of J.V.B. Financial Group has joined Loop Capital Markets LLC and Tigress Financial Partners LLC as capital markets advisors to NUBURU and TWND. Morrison & Foerster LLP is serving as legal counsel to all three capital markets advisors.

FAQs

After announcing the go-public transaction with NUBURU, TWND released an initial “Twenty Questions” and additional “FAQs” that address many of the commonly-asked questions about TWND’s innovative preferred share structure and the Company Notes. As outlined in the FAQs, each non-redeeming shareholder of TWND at the closing of the proposed business combination will receive one (1) preferred share in addition to retaining the one (1) non-redeemed common share. Both sets of FAQs are available on NUBURU’s website and for download and on SEC.gov.

About NUBURU

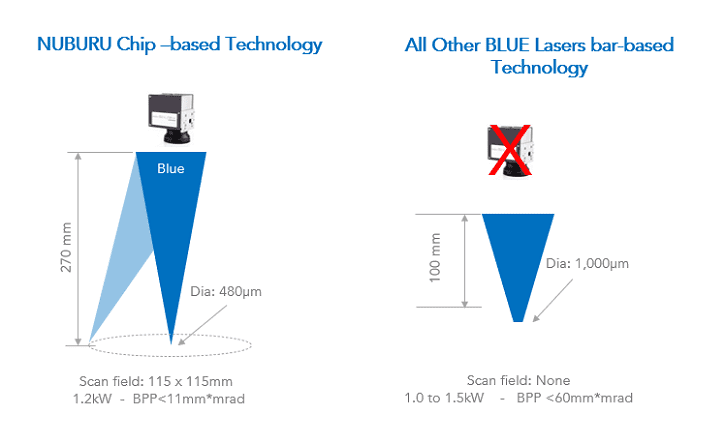

Founded in 2015, NUBURU® is leading the transformation to a world of high-speed, high-quality metal machining and processing. NUBURU’s ground-breaking blue laser technology has defined a new class of high-power, high-brightness blue lasers, starting with the standard AO™ laser and the extreme-brightness AI™ laser, which each enable radical gains in speed and quality for metal processing. For more information, visit the company’s website at www.nuburu.net.

About TWND

TWND is a blank check company formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses. TWND seeks to capitalize on the decades of combined investment experience of its management team, board of directors and Advisors who are both technology entrepreneurs as well as technology-oriented investors with a shared vision of identifying and investing in technology companies. The Company is led by Chairman Philip Krim, Chief Executive Officer Chris Hollod and Chief Financial Officer Matt Eby. In addition to the members of its management team and board of directors, TWND has assembled an Advisory Board that helps position the Company as the value-add partner of choice for today’s leading entrepreneurs.

Caution Regarding Forward-Looking Statements

This press release contains certain “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended, including certain financial forecasts and projections. All statements other than statements of historical fact contained in this press release, including statements as to future results of operations and financial position, revenue and other metrics planned products and services, business strategy and plans, objectives of management for future operations of NUBURU, market size and growth opportunities, competitive position and technological and market trends, are forward-looking statements. Some of these forward-looking statements can be identified by the use of forward-looking words, including “may,” “should,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” “plan,” “targets,” “projects,” “could,” “would,” “continue,” “forecast” or the negatives of these terms or variations of them or similar expressions. All forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. All forward-looking statements are based upon estimates, forecasts and assumptions that, while considered reasonable by TWND and its management, and NUBURU and its management, as the case may be, are inherently uncertain and many factors may cause the actual results to differ materially from current expectations which include, but are not limited to: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the business combination agreement with respect to the business combination; (2) the outcome of any legal proceedings that may be instituted against NUBURU, TWND, the combined company or others following the announcement of the business combination and any definitive agreements with respect thereto; (3) the inability to complete the business combination due to the failure to obtain approval of the stockholders of TWND or the stockholders of NUBURU, or to satisfy other closing conditions of the business combination; (4) changes to the proposed structure of the business combination that may be required or appropriate as a result of applicable laws or regulations or as a condition to obtaining regulatory approval of the business combination; (5) the ability to meet NYSE’s listing standards following the consummation of the business combination; (6) the risk that the business combination disrupts current plans and operations of NUBURU as a result of the announcement and consummation of the business combination; (7) the inability to recognize the anticipated benefits of the business combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees; (8) costs related to the business combination; (9) changes in applicable laws or regulations; (10) the possibility that NUBURU or the combined company may be adversely affected by other economic, business and/or competitive factors; (11) the inability to obtain financing from Lincoln Park Capital; (12) the risk that the business combination may not be completed in a timely manner or at all, which may adversely affect the price of TWND’s securities; (13) the risk that the transaction may not be completed by TWND’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by TWND; (14) the impact of the COVID-19 pandemic, including any mutations or variants thereof, and its effect on business and financial conditions; (15) volatility in the markets caused by geopolitical and economic factors; and (16) other risks and uncertainties set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in TWND’s Form S-1 (File No. 333-248113), Quarterly Report on Form 10-Q for the period ended June 30, 2022 and registration statement on Form S-4 that TWND intends to file with the SEC, which will include a document that serves as a prospectus and proxy statement of TWND, referred to as a proxy statement/prospectus and other documents filed by TWND from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Nothing in this press release should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. Neither TWND nor NUBURU gives any assurance that either TWND or NUBURU or the combined company will achieve its expected results. Neither TWND nor NUBURU undertakes any duty to update these forward-looking statements, except as otherwise required by law.

Important Information and Where to Find It

On August 18, 2022, TWND filed a definitive proxy statement (the “Extension Proxy Statement”) for a special meeting of the stockholders to be held to approve an extension of time for TWND to complete an initial business combination through March 9, 2023 (the “Extension Proposal”). The Definitive Extension Proxy Statement was sent to TWND’s stockholders of record as of the record date set therein. Stockholders may also obtain a copy of the Definitive Extension Proxy Statement at the SEC’s website (www.sec.gov).

Additional Information

This press release relates to a proposed transaction between Tailwind Acquisition Corp. (“TWND”) and NUBURU, Inc. (“NUBURU”). TWND intends to file a registration statement on Form S-4 with the Securities and Exchange Commission (the “SEC”), which will include a document that serves as a prospectus and proxy statement of TWND (the “Business Combination Proxy Statement”). The Business Combination Proxy Statement will be sent to all TWND stockholders. TWND also will file other documents regarding the proposed transaction with the SEC.

Before making any voting decision, investors and security holders of TWND are urged to read the Extension Proxy Statement, the registration statement, the Business Combination Proxy Statement and all other relevant documents filed or that will be filed with the SEC in connection with the proposed transaction as they become available because they will contain important information about the proposed transaction.

Investors and security holders will be able to obtain free copies of the registration statement, the Business Combination Proxy Statement and all other relevant documents filed or that will be filed with the SEC by TWND through the website maintained by the SEC at www.sec.gov. The documents filed by TWND with the SEC also may be obtained free of charge upon written request Tailwind Acquisition Corp., 1545 Courtney Avenue, Los Angeles, CA 90046.

NEITHER THE SEC NOR ANY STATE SECURITIES REGULATORY AGENCY HAS APPROVED OR DISAPPROVED THE TRANSACTIONS DESCRIBED IN THIS PRESS RELEASE, PASSED UPON THE MERITS OR FAIRNESS OF THE BUSINESS COMBINATION OR RELATED TRANSACTIONS OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THIS PRESS RELEASE. ANY REPRESENTATION TO THE CONTRARY CONSTITUTES A CRIMINAL OFFENSE.

Learn more at https://twnd.tailwindacquisition.com/.

Participants in the Solicitation

TWND and NUBURU and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from TWND’s stockholders in connection with the proposed transactions. TWND’s stockholders and other interested persons may obtain, without charge, more detailed information regarding the directors and executive officers of TWND listed in TWND’s registration statement on Form S-4, which is expected to be filed by TWND with the SEC in connection with the business combination. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to TWND’s stockholders in connection with the proposed business combination will be set forth in the proxy statement/prospectus on Form S-4 for the proposed business combination, which is expected to be filed by TWND with the SEC in connection with the business combination.

No Offer or Solicitation

This press release is not intended to and does not constitute an offer to sell or the solicitation of an offer to buy, sell or solicit any securities or any proxy, vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be deemed to be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act.